Running a dental practice means wearing many hats: clinician, manager, leader, and sometimes accountant. While most dentists prefer focusing on patient care, the reality is that understanding dental practice accounting is vital for a thriving, financially healthy practice. Proper accounting isn’t just about keeping books in order; it’s about clarity, knowing where your revenue comes from, which services drive profitability, and how to forecast sustainable growth.

This essential function ensures that the revenue generated from procedures, insurance reimbursements, and patient payments is accurately tracked and reconciled. Yet, many practices still struggle with outdated accounting methods or mismatched software that create inefficiencies and confusion.

In today’s digital-first environment, modern cloud-based dental management software, such as DentiMax Flow, is transforming how practices handle accounting, reporting, and collections. Let’s unpack how dental accounting works, why line-item accounting is revolutionizing the field, and which tools can help your practice stay organized, transparent, and profitable.

What Is Dental Practice Accounting?

At its core, dental practice accounting isn’t just about balancing the books, it’s tracking all financial activities that occur within your office, from patient payments and insurance reimbursements to payroll and supplies. A well-structured accounting system ensures every dollar is recorded, categorized, and easily traceable.

In a typical dental practice, accounting involves three major processes:

- Bookkeeping: Recording income and expenses.

- Billing and Collections: Managing insurance claims and patient payments.

- Financial Reporting: Generating profit-and-loss statements, cash flow reports, and production summaries.

It’s about creating financial visibility and ensuring that every procedure performed translates into proper revenue collection.

A well-structured accounting process tracks:

- Patient charges for procedures

- Insurance claims and reimbursements

- Adjustments (discounts, write-offs, refunds)

- Payments and outstanding balances

Traditional accounting systems often lump these together into large, generalized “batches.” This approach, known as “bulk accounting,” makes it difficult to see exactly what services have been paid, what remains pending, and where discrepancies exist. This lack of granularity not only makes reconciling patient accounts a headache but can also cause confusion when patients ask, “What exactly did I pay for?” or “Why do I still have a balance?”

Dental accounting introduces complexities not seen in other industries, namely, the role of insurance reimbursements, treatment plan estimates, and adjustments that occur after claims are processed.

That’s where line-item accounting changes everything.

The Shift Toward Line-Item Accounting

“Line-item accounting” has become a buzzword in the dental industry, and for good reason. Instead of combining all transactions into a single lump sum, this approach breaks down each charge, adjustment, and payment at the individual procedure level. This precision allows dental teams to see exactly what has been paid, what’s pending, and what’s still owed. When insurance payments arrive out of order (a common occurrence), line-item accounting makes it clear which procedures were covered and which were not.

The benefits are transformative:

- Transparency: Patients understand their balances clearly.

- Efficiency: No more wasted time searching for mismatched payments.

- Accuracy: Each transaction is tied to a specific CDT code.

- Compliance: Provides a clear audit trail for financial integrity.

This level of transparency gives practices full visibility into each patient’s financial history, ensuring no hidden or misapplied credits. It provides clarity and trust not only for the staff, but also for the patients. It’s the difference between knowing exactly what you’ve been paid for and simply guessing.

Common Payment Collection Methods

Every dental office has its own approach to collecting payments.

Upfront Payment

The patient pays the full amount before treatment. Insurance reimbursements are later sent directly to the patient.

- Pros: Simplifies accounting and ensures full payment.

- Cons: Can discourage treatment acceptance due to high out-of-pocket costs.

Estimated Payment

The office collects an estimated patient portion at the time of service, based on expected insurance coverage.

- Pros: Balanced approach with predictable cash flow.

- Cons: Requires strong insurance verification and accurate estimates.

Post-Treatment Billing

The office waits for insurance payment before billing the patient the remaining balance.

- Pros: Convenient for patients.

- Cons: Risky for the practice, delayed collections, and potential write-offs.

A hybrid model, where partial upfront payment is collected, tends to work best. This keeps accounts manageable and minimizes unpaid balances.

How Dental Accounting Software Simplifies It All

Accounting software is the engine that powers your financial clarity. It manages daily transactions, automates reconciliations, and provides real-time reports. Yet, not all dental accounting software is created equal.

Many legacy systems, even those used by large dental service organizations (DSOs), are limited by outdated architecture. They require manual backups, local installations, and frequent maintenance.

Enter Cloud-Based Dental Software

Manual bookkeeping and spreadsheets simply can’t handle the complexity of modern dental billing. That’s where dedicated dental practice management and accounting software come in.

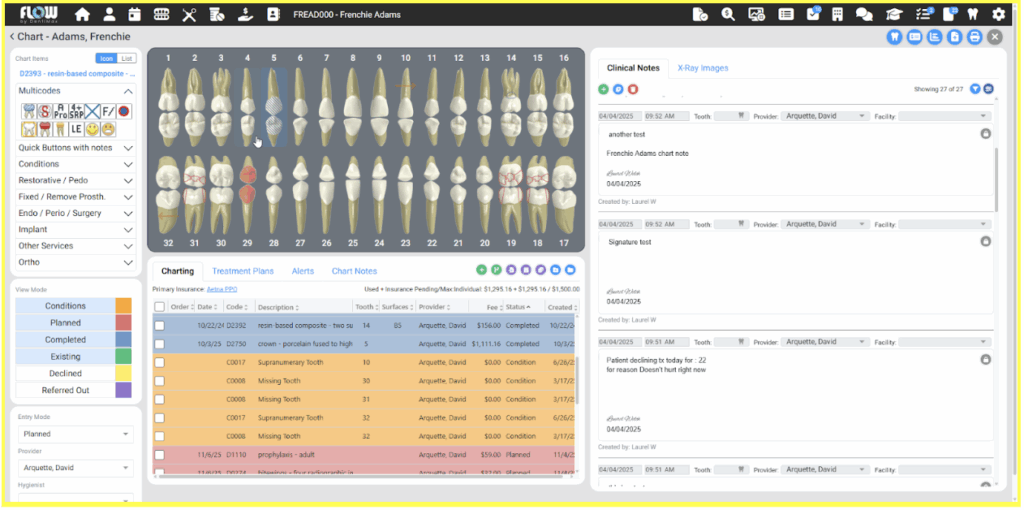

Solutions like DentiMax Flow were built specifically for dental offices, combining clinical, administrative, and financial management in one seamless platform.

Here’s what makes today’s dental accounting software indispensable:

- Seamless Integration with Clinical Data:

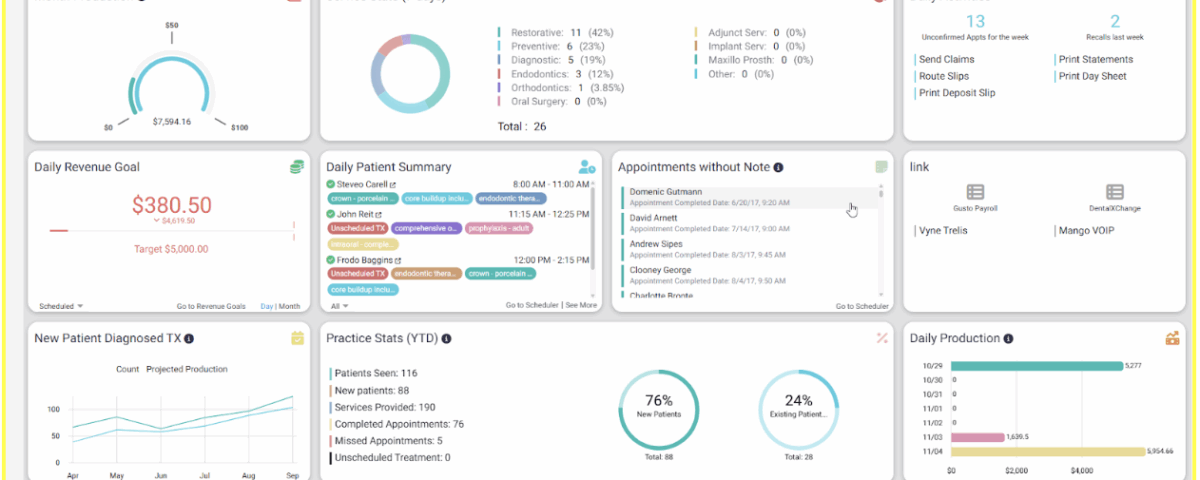

Modern software links treatment planning, procedure codes, and billing. When a dentist completes a treatment, the system automatically updates the ledger, ensuring no charges are missed and all documentation matches. - Real-Time Reporting:

Instead of waiting for monthly statements, practices can now view production, collections, and outstanding balances in real time. This allows for quick course corrections, whether that’s addressing overdue claims or optimizing scheduling for higher-value procedures. - Insurance Management:

Software like DentiMax automates claim submission, tracks claim status, and alerts staff when follow-up is needed. By minimizing manual errors and delays, practices see faster reimbursements and fewer write-offs. - Role-Based Permissions and Audit Trails:

Every transaction can be monitored, edited, and traced back to a user, ensuring accountability. This feature helps prevent unauthorized adjustments while allowing authorized staff to fix errors transparently.

Why DentiMax Flow Is Leading the Way

Among modern dental software options, DentiMax Flow stands out as a true cloud-based, browser-accessible platform designed for both front and back-office synergy.

Unlike traditional programs that require installation and local servers, Flow operates entirely in the cloud. That means there’s nothing to download, no server maintenance, and no IT overhead. As long as you have internet access, you can manage your practice from any device.

Key Advantages of DentiMax Flow

- True Cloud Access:

100% browser-based, with instant access anywhere. No downloads or installations. If you have internet access, you have your office. This browser-based design ensures seamless operation on any device. You can manage your practice from a desktop, tablet, or mobile. - User-Friendly Design:

Built for real-world dental workflows, allowing front desk, clinical, and billing teams to work in a harmonious, streamlined workflow. - Flexible Access:

Perfect for family practices, startups, mobile dentistry, mid-large size organizations, independent hygienists, and billing specialists. - Data Security:

HIPAA-compliant cloud infrastructure keeps patient and financial data secure. - Future-Ready:

DentiMax plans to offer seamless data conversions soon, giving practices the ability to upgrade from legacy systems easily. - Ideal for Any Practice Type:

From family practices and startups to mobile dentistry and dental billing services, DentiMax Flow offers scalable tools for every environment.

This all-in-one approach brings together the operational, clinical, and financial elements of your practice, allowing for better visibility and less administrative friction.

How Line-Item Accounting Works in DentiMax Flow

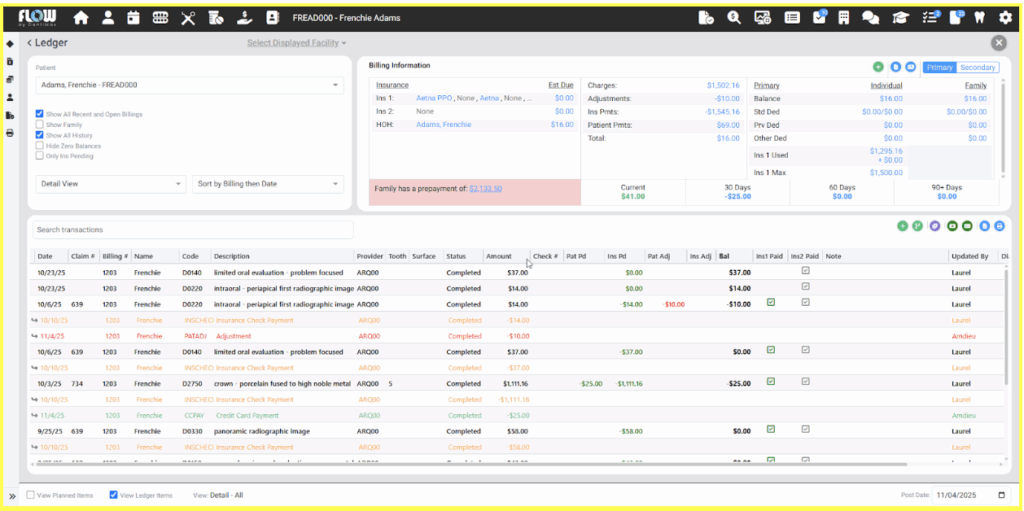

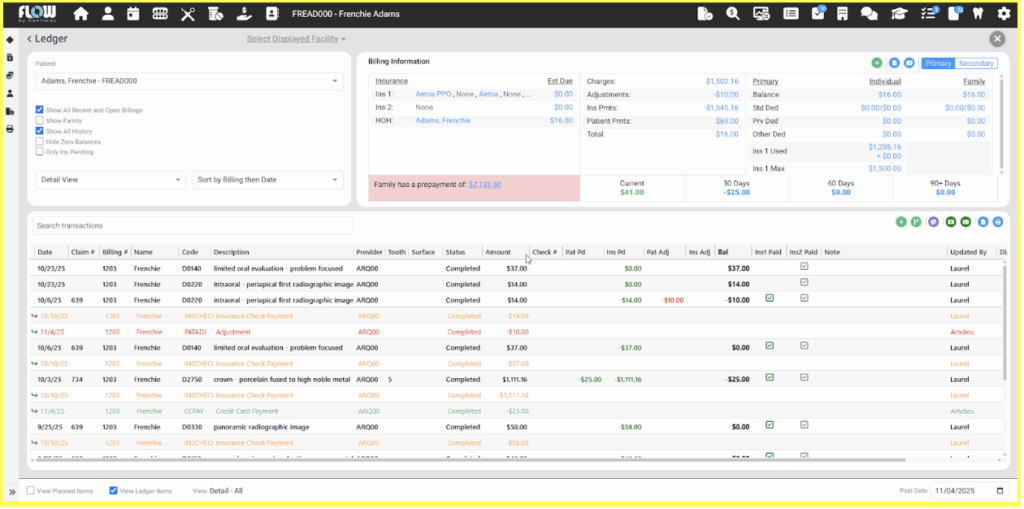

DentiMax Flow’s line-item accounting features are specifically designed to eliminate the inefficiencies that plague older systems. Every transaction, whether an insurance payment, patient payment, or write-off, is linked directly to the exact procedure it covers.

This granular approach means your team can:

- Instantly identify unpaid or partially paid procedures

- Spot discrepancies in insurance reimbursements

- Correct errors quickly without guesswork

- Maintain cleaner ledgers and smoother audits

If a patient’s insurance pays out of order, Flow immediately shows which procedures have been reimbursed and which are still pending. This level of detail not only simplifies reconciliation but also prevents costly billing errors. Its ledger search feature allows users to find transactions by date, amount, or type, a major time saver compared to legacy software that buries data in bulk records.

The ability to edit transactions while keeping security oversight is a game-changer, allowing authorized users to make corrections transparently, with a clear audit trail.

Optimizing Collections and Cash Flow

Cash flow is the lifeblood of every dental office. Even with accurate records, practices can struggle to collect payments efficiently. Many offices fall behind because they either wait too long to follow up on claims or allow patients to delay balances indefinitely.

To combat this, practices use three main collection strategies:

- Collecting Upfront: Asking patients to pay in full at the time of service.

- Estimated Collection: Charging an estimated patient portion while awaiting insurance payment.

- Post-Treatment Billing: Sending statements after insurance pays (least effective).

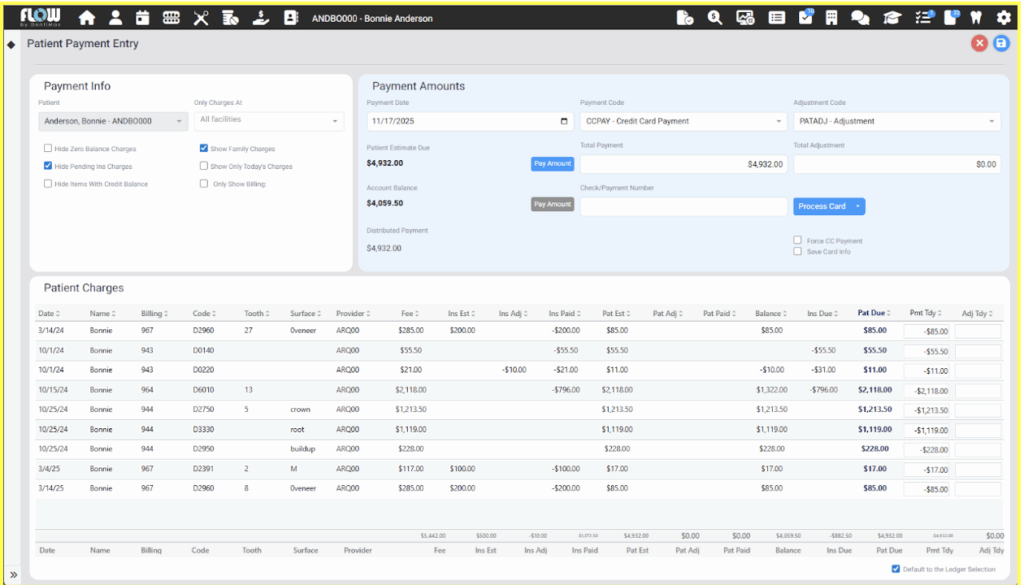

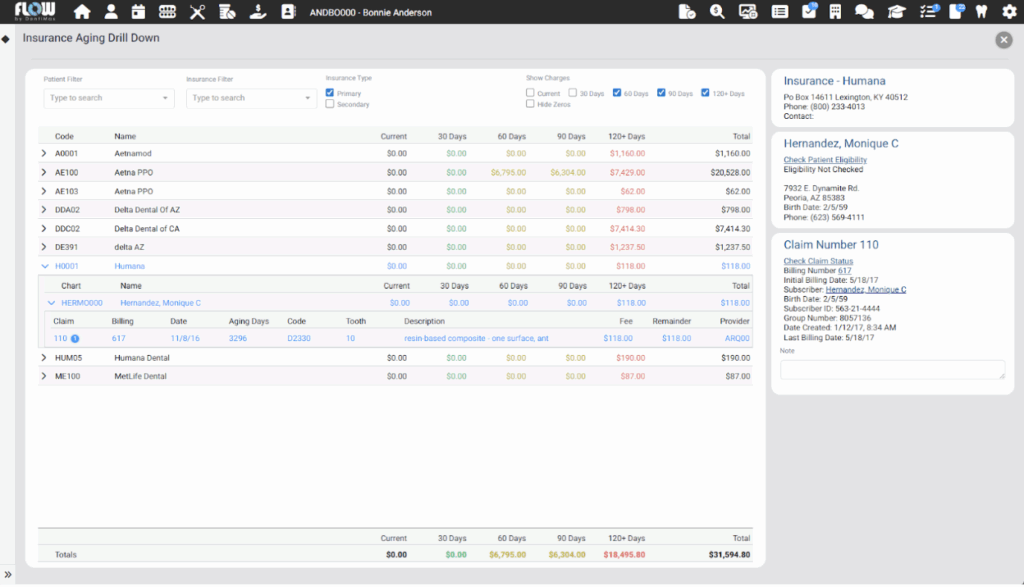

Accounting automation doesn’t just save time, it improves cash flow. DentiMax Flow includes built-in tools for:

- Claims management: Submit, track, and reconcile insurance claims from within the system.

- Payment posting: Automatically apply payments to the correct procedures.

- Aging reports: Quickly identify overdue accounts for follow-up.

- Patient statements: Generate clear, itemized statements that reduce confusion and disputes.

This level of automation is critical for financial efficiency. The system even allows you to create custom payment plans or generate real-time estimates for patients, boosting both transparency and collection rates. By cutting down on manual entry and repetitive tasks, your staff can focus more on patient care and less on spreadsheets.

Data Conversion and Setup

DentiMax Flow currently offers data conversions from most any other software. Alternatively, manually entering patient and billing data allows practices to clean up old, inaccurate records during migration, a process that improves future reporting accuracy and reduces clutter.

According to DentiMax’s team, automated data import functionality will be available soon, making transitions even easier.

Security, Compliance, and Accessibility

Since DentiMax Flow is true browser-based software, it’s hosted securely in the cloud with built-in HIPAA compliance and data encryption. You never have to worry about lost backups or on-site server maintenance.

And because it’s accessible from any internet-connected device, you can manage your practice, from appointment scheduling to accounting, anytime, anywhere.

Why Cloud-Based Accounting Is the Future

Beyond convenience, cloud-based accounting brings scalability, flexibility, and security to modern dental practices. It enables seamless collaboration between remote billers, consultants, and accountants, all without compromising patient privacy or data protection.

With automatic updates and centralized data, cloud-based systems ensure your team always works with the latest CDT codes, fee schedules, and reporting tools. There’s no need for manual patches, software installations, or version conflicts.

As the dental industry continues to evolve toward integrated digital ecosystems, combining practice management, imaging, and accounting under one platform, solutions like DentiMax Flow are setting the new standard. By aligning compliance, efficiency, and patient experience, cloud technology is redefining how dental practices operate and grow.

The Power of Integrated Financial Visibility

Cloud-based platforms like DentiMax Flow don’t just simplify accounting; they connect clinical and financial data in real time. This integration ensures that financial reports accurately reflect patient care activities, giving practices a complete picture of their business health.

With DentiMax Flow, practice owners gain visibility into:

- Production vs. collections

- Provider-level revenue tracking

- Unpaid claims and outstanding balances

- Daily deposit summaries and detailed ledgers

- Top revenue performing dental procedures

This depth of insight empowers smarter decisions about staffing, marketing, and financial strategy. By bridging the gap between patient care and profitability, integrated accounting software like DentiMax Flow transforms data into actionable intelligence, helping your practice stay both compliant and competitive in an increasingly digital world.

Transform Your Dental Practice

Dental practice accounting is no longer a behind-the-scenes function; it’s a strategic driver of practice success. As more practices adopt line-item accounting and shift to cloud-based solutions, financial clarity is becoming as essential as clinical precision.

If your current system feels outdated, lacks transparency, or makes month-end reconciliation a nightmare, it might be time to explore a modern solution built for today’s dental realities.

With DentiMax Flow Cloud Software, you get the power of true cloud access, line-item accuracy, and an intuitive interface that unites your front and back offices seamlessly. Whether you’re a solo practitioner or part of a growing group, Flow adapts to your workflow, helping you manage smarter, collect faster, and focus on what matters most: exceptional patient care.